Investment Newsletter - November 2022

November Newsletter

Good afternoon,

Newton’s Third Law of Motion states that for every action, there is an equal and opposite reaction.

This quote is very well-known within the scientific community. In finance, there have been historical events where we can also observe this phenomenon. For example, when we see the value of an asset increasing, we can observe that the value of another asset decreases, although not necessarily with an equal magnitude.

For the past two decades, we have seen traditional investments such as equities and bonds were negatively correlated. This means that when the price of equities increases, the price of bonds decreases, and vice versa. Because of this, fund managers will tend to allocate a portion of their portfolios to bonds to reduce risk and manage volatility.

However, 2022 shows us otherwise. Equities and Bonds have both decreased (Positive Correlation).

It is worth noting that 2022 is not a unique case. There have been instances in the past that it is positively corelated or have positive correlation.

Fund managers throughout the decades have become more and more creative, branching out with the investment instruments they use, on top of the traditional investments - these are called alternative investments. Alternative investments can include cryptocurrency, commodities, and derivatives.

With the equity and bond markets both being down, would alternative investments, be a better way to reduce risk?

In this newsletter, we could look at cryptocurrency, commodities, and derivatives but it would be a very long, winded newsletter! Instead, we will just look at cryptocurrency.

In simple terms, cryptocurrency is a type of digital or virtual currency. It can serve as ordinary money, but it has no physical counterparts, such as banknotes or coins that can be carried around. Cryptocurrency exists only in electronic form.

“Everything you don’t understand about money combined with everything you don’t understand about computers.”—HBO’s Last Week Tonight with John Oliver, March 11, 2018

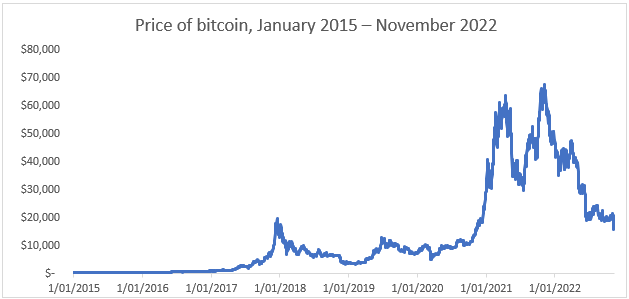

Cryptocurrencies, such as Bitcoin have been given great attention due to its meteoric rise in value in recent years. Given its dramatic price changes, it is not surprising that investors are looking into the role of cryptocurrencies in a portfolio.

Price of Bitcoin, January 2015 – November 2022

Source: Bitcoin USD (BTC-USD) Price History & Historical Data - Yahoo Finance

In assessing the merits of allocating cryptocurrency into a portfolio to reduce risk, let’s first look at the factors in determining the components of a portfolio. The two most common factors are that the assets should achieve a positive expected return over time, and the assets should help mitigate uncertainty.

Let’s look at the expected return criterion of the most widely recognized cryptocurrency, Bitcoin. It is unclear of whether investing in Bitcoin has a positive expected return. This is because it offers no claim on future profits of a company, as one gets with equities, and receives no interest payments, as one is entitled to with a bond. Bitcoin’s returns are derived from holding and depending on it appreciating in value against the dollar, which is a speculative investment.

It is also unclear how Bitcoin can help investors manage risk given that this asset has historically fallen in value by double-digit percentages in a single day. Therefore, the extreme fluctuation of Bitcoin is not a suitable asset to hold to reduce risk. Because of this, we do not believe that allocating capital to cryptocurrency reduces portfolio risk.

If you wish to further discuss about alternative investments or any other topics with us, please let us know and we can arrange accordingly.

Withdrawals pre-Christmas

With the Christmas break quickly approaching, we know that this is a time when extra funds may be required.

In early December is when we conduct a rebalance of portfolios to account for withdrawals for the holiday period. This year, we will process this on Monday, the 5th of December. If you require any one-off withdrawals or require additional funds before Christmas Eve, please let your adviser know, or reply to this email before Thursday, the 1st of December so we can account for this when rebalancing.

The funds will be paid out within 10 business days.

Please note that regular withdrawals that has been set prior to this are unaffected. You can expect your regular withdrawals to occur automatically, on the date you have specified (or the business day after).

As always if you require the funds to be withdrawn after this period, we can still arrange for this to be done. Please contact us at advisersupport@foxplan.nz or info@foxplan.nz and we will assist you.

FoxPlan’s offices will be closed from the afternoon of the 21st of December 2022 and will re-open on the 9th of January 2023. During this period, if you have any urgent requests, please see below the list of our investment supplier details.

As we wrap up 2022, from all of us at FoxPlan, we would like to wish you Merry Christmas and a Happy New Year. We look forward to assisting you with your plans through 2023 and beyond. You can read all of our investment newsletters throughout the year on our website by clicking the link below.

Kind Regards,

The FoxPlan Team