Investment Newsletter - September 2022

September Newsletter

Good Afternoon,

In the words of Paul Samuelson, an American economist,

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

- Paul Samuelson

Paul was the first American to be awarded the Nobel Memorial Prize in Economics for his outstanding contributions.

But why should investing be a slow, long process? If our investments go up, shouldn’t we quickly sell the investments to avoid the investments going back down? Why should we risk riding volatility in the market?

In this newsletter, we will touch on delayed gratification and the studies that surround this.

In an era of instant responses and speedy deliveries, we have now become accustomed to things being fast, quick and prompt. From the moment we wake up, we can do a quick search on the internet, and it would show us today’s weather forecast, traffic details and the latest news, all while sipping freshly prepared instant coffee.

It gives us instant satisfaction when we obtain what we want in mere seconds. This is not exclusive to the tangible items in our daily lives. Even financial markets experience this phenomenon. People feel euphoric when the value of their investments go up, and then quickly sell the investments to capture the profit they have made. On the other side of the token, a sense of panic kicks in and people sell their investments after seeing the markets drop. Both are fundamental investment mistakes: Euphoria, and Panic. The worse of these is Panic.

Not knowing, they could miss out on potentially greater returns if they view investments as part of their long-term plan.

An experiment was conducted in 1972 by a professor at Stanford University aimed to study delayed gratification. Children were given the option, either to have one marshmallow right now, or two marshmallows if they waited for a while. In follow-up studies, the researchers found that children who were able to wait longer tended to have better life outcomes, which were measured by SAT scores, educational attainment, and many other measures.

How does the Stanford Marshmallow experiment relate to investing?

Example: Let’s take the S&P 500 index in 2020 for perspective.

Let’s say you invested in the S&P 500 on the first trading day of 2020. There are two scenarios:

Scenario 1 – Quickly sell to realize your gains

If you sold on 09/02/2020, just before the stock market crash due to the pandemic. You would have gained: 4.18%. Not bad.

Scenario 2 – Wait until the end of the year

If you held on to the investment until the last trading day of the year, you would have gained: 15.76%. Throughout the year, you may have experienced a very volatile market; a very sharp decline early in the year and then the stock market went to all-time highs.

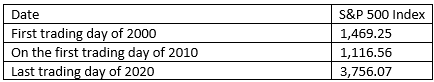

But this is a one-year timeframe, let’s look at a 21-year timeframe, starting from January 2000 until December 2020.

S&P500 1 January 2000 - 31 December 2020

You invested in the S&P 500 on the first trading day of the year 2000. There are two scenarios:

Scenario 1 – Selling your investments mid-way

If you sold your investments halfway through the period on, the first trading day of 2010, you would have lost 24%.

Scenario 2 – Wait until the end of the period

If you held on to the investment until the last trading day of the 21-year period, you would have gained: 155.65%. Throughout the period, you have experienced at least 5 bear markets, in which the S&P 500 had more than a 20% decline.

While there is never certainty surrounding investments, we can use past data to project what investments might do. The key is to not be impulsive, but rather look at how your investments have done in the long-term. Our part as financial advisers is to assess and assimilate knowledge on financial markets to your investment planning. From there, we monitor the efficacy of the plan and the investments it entails.

If you would like to discuss your situation with us, we are only a phone call or an email away. Please get in contact with us on 0800 NO STRESS (0800 667 873) or email at info@foxplan.nz if you have any questions or would like your adviser to talk through your current investment plan.

Kind Regards,

The FoxPlan Team