Why Passive Investing: Eugene Fama and The Efficient Market Hypothesis

Last month, many of you would have heard about the happenings with GameStop – this newsletter isn’t going to delve too far into the details; there’s countless articles already online doing just that. Rather, this newsletter shall aim to expand on FoxPlan’s investment philosophy, looking at the fundamental theories which have led to our promotion of taking a passive stance on investments – using GameStop as an example to highlight the argument for passive investing.

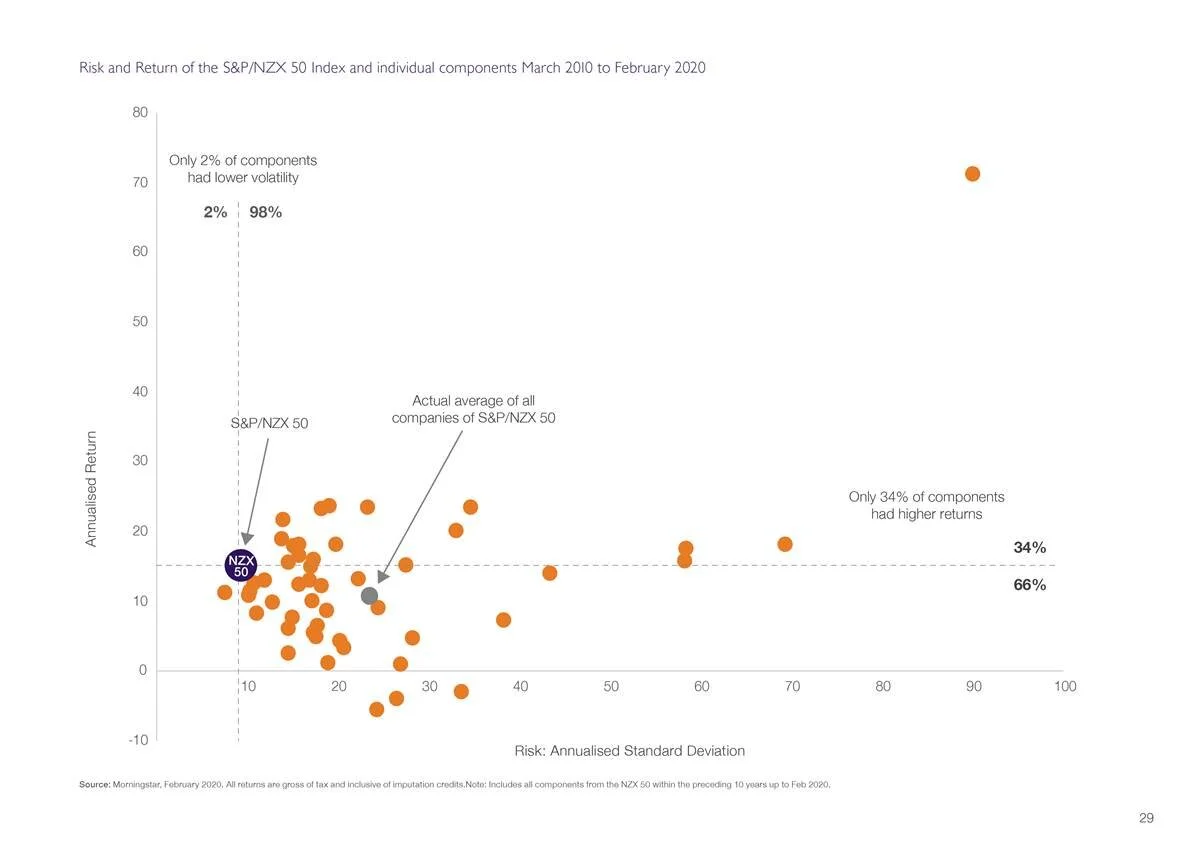

Fundamentally, a passive investment strategy is one in which you trust the markets, knowing that historically they have gone up, and having faith that such a trend will continue. A simple example of a passive investment strategy would be putting your funds into the NZ Stock Exchange Top 50 (NZX 50) shares or S&P 500 as a whole, rather than picking a few select companies. Through such a strategy, an investor can expect their return to match that of the market (minus fees).

The alternative approach is actively picking and choosing stocks – ultimately speculating which stocks are likely to rise the most over the next quarter/year and putting additional funds towards those particular stocks. The objective for all active investors, whether they are individuals or large fund managers, is to try to outperform the market. Whilst this approach has historically been favoured, statistics and academic research prove asset allocation and index-based options outperform, and over the past two decades have led the smart money away from, active investment options.

To understand why passive investment strategies consistently outperform active investment strategies, you could read in detail about the Efficient Market Hypothesis – a theory which is largely attributed to Eugene Fama. It suggests that stock prices reflect all available information – therefore active investors can theoretically only beat the market through insider knowledge or making speculative investments (picking a stock and praying it was the right one). So, whilst some active funds may achieve a degree of outperformance in the short-term, correctly guessing the right stocks over a 10,15 or even 20-year period is exceptionally unlikely.

In addition to his work in developing the Efficient Market Hypothesis, Eugene Fama is also widely known for his empirical studies on asset pricing and active versus passive fund performance. Such research has validated his Hypothesis, as have more recent studies such as those by Morningstar (see link below – further reading). A clear insight from these studies is that the success rate of active funds dwindles lower and lower over longer timeframes.

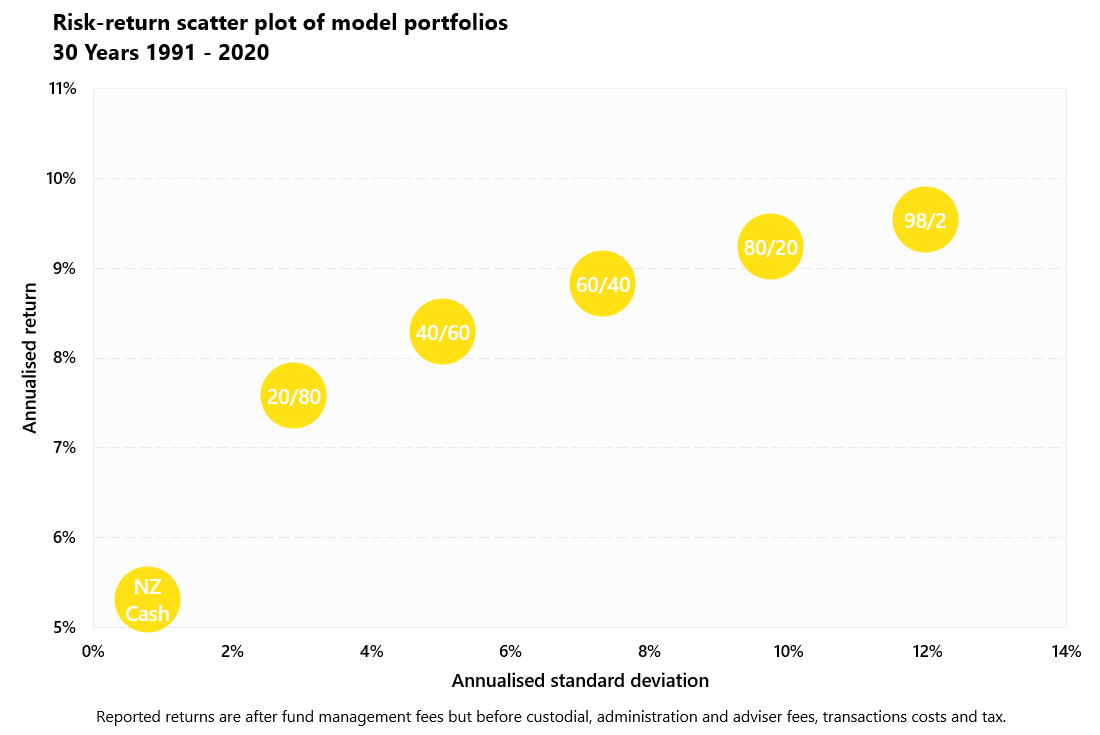

Please refer to the graphical depiction below of portfolios which maximize returns for the risk associated with them rather than picking individual stocks and hoping to get lucky.

At FoxPlan, we primarily focus our clients towards investing into asset class index-based strategies utilising the wisdom of this academic research.

So, how do the recent events surrounding GameStop exemplify the issues with active investing? Several large actively managed hedge funds lost billions due to their short-position (a bet on the direction they thought the stock price would move) on GameStop, whilst countless retail investors also lost varying amounts of money due to jumping on a short-lived bandwagon, right as the stock’s value plummeted back down. Essentially, what we saw happen could be compared to buying lotto tickets – gambling. Conversely, investing, which if done appropriately over a long period, can positively impact your wealth.

One of the big downsides to what has happened with GameStop is that many of those who lost money may now be scared of losing again, and thus avoid investing in stocks for many years to come. They would thereby miss out on the real benefits of a diversified index-based strategy optimised for their particular goals.

If you’re interested in learning more about the topics addressed in this newsletter, here are some links to get you started:

If you have any questions, or would like to discuss this further, please get in touch.

Kind regards,

Warwick Walker

The views and opinions expressed in this article are not intended to be a personalised service for an individual retail client. The views and opinions are general in nature, may not be relevant to an individual's circumstances, and constitute class service only. Before making any investment, insurance or other financial decisions, you should consult a professional financial adviser of FoxPlan Limited. You can find more important information about us here.