Timing the market or time in the market?

In our latest episode, we discussed three different ways of approaching investment. Putting in a lump sum of money, putting in smaller amounts over a period of time, or delaying it. Fundamentally this comes down to trying to time the market.

Let’s look at the test by the Charles Schwab Corporation which we referenced, comparing 5 investing styles (we only talked about three of these in the podcast).

Consider these five hypothetical investors all with different investment approaches, regarding timing their investing.

The following investors all had $2,000 at the beginning of the year to invest in the S&P 500 Index, for 20 years ending 2020.

1. Peter Perfect Peter was extremely lucky as he had timed the market perfectly every year. (What are the chances of that?) He waited and invested the $2,000 at the lowest point of each year. For example, in 2001, he invested in the S&P 500 on September 21, 2001 – the year’s lowest closing level.

2. Ashley Action Ashley took immediate action, where she invested $2,000 in the market on the first trading day of the year.

3. Matthew Monthly Matthew splits his $2,000 into 12 equal portions and invests each portion at the beginning of each month.

4. Unfortunate Umbridge Ms. Umbridge had poor timing in investing in the market. She invested $2,000 each year at the market’s peak every year. (What are the chances of that?) For example, in 2001, she had invested her $2,000 on January 30, 2001 – the year’s highest closing level.

5. Larry Linger Larry anticipated purchasing when the market further plummets, however, decided to pull the handbrakes when the market prices went back up. He was convinced to keep his capital available to purchase stocks at lower prices that were just around the corner.

Larry eventually did not invest in the S&P 500 and invested in Treasury bills each year.

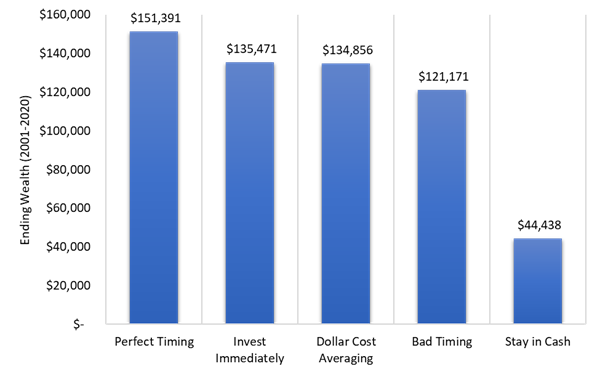

The results:

Source: Schwab Center for Financial Research. Invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2001-2020.

A study from Schwab Center for Financial Research found that in a span of 20 years from 2001 to 2020, Peter Perfect, who perfectly timed the market had the greatest return, while Ashley Action, came second, followed by Matthew Monthly, Unfortunate Umbridge, and lastly Larry Linger.

An investor who attempts to time the market not only has to predict the direction and movement of the market, but they also need to pinpoint the lowest closing day of the year, consistently, which is extremely unlikely.

Timing the market requires an extensive time commitment, knowledge, and a large degree of luck. Because many investors are occupied with work, family, and other pursuits, they might not be able to invest at the lowest point of each year.

Hence, investing immediately, or to dollar cost average is a more realistic approach to investing.

In the long run, it is better to be investing, even at the worst timing, than to not be investing at all.