KiwiSaver Homeownership Guide: Using Your Savings to Secure Your First Home

Did you know you can use your KiwiSaver for your first home?

You can use your balance for your whole deposit or just part of it and you might even be able to get a First Home Grant!

Check if you’re eligible to use your KiwiSaver for a first home deposit today!

What is KiwiSaver?

Why should I be in KiwiSaver?

How do contributions work?

How much will I have when I'm ready to buy? Try our KiwiSaver calculator

Are you in the correct fund?

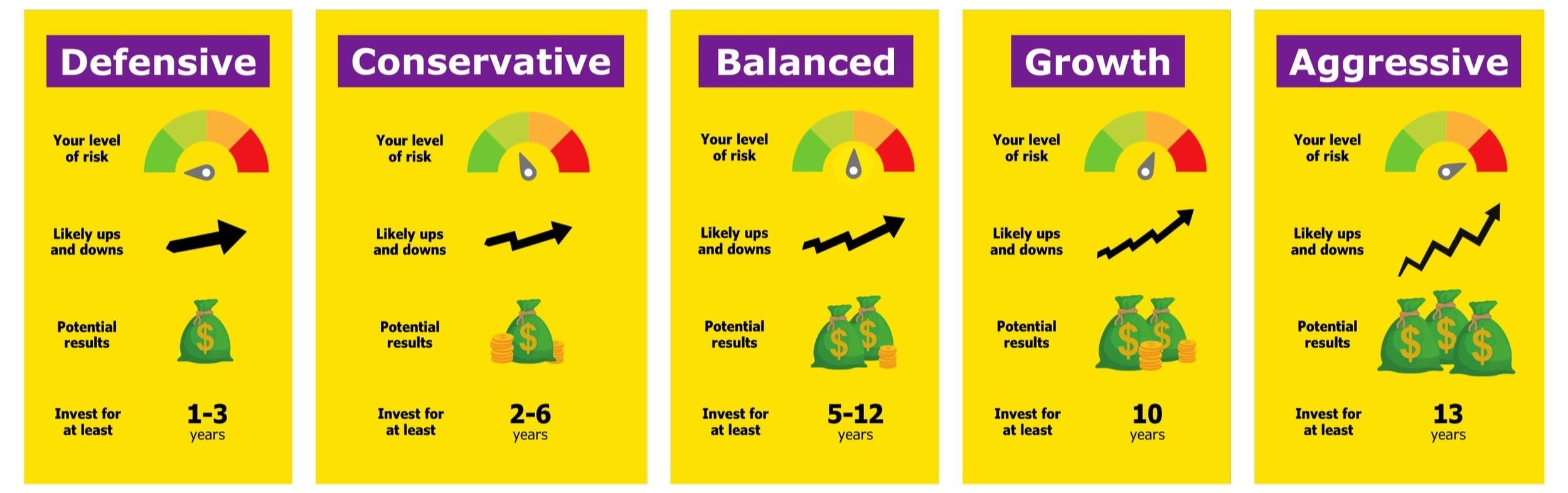

We've simplified the many KiwiSaver funds into five categories based on the amount of riskier assets, such as stocks and real estate, that they own.

Depending on when you want to use the money and your attitude towards risk, one type (defensive, conservative, balanced, growth, or aggressive) will probably work best for you.

Frequently Asked Questions

What is KiwiSaver?

To explain KiwiSaver simply, you contribute from your pay each week and in addition, your employer and government contribute on your behalf. The amount and frequency depend on your employment. Your contributions then get invested on your behalf by a KiwiSaver provider.

Why are there different funds?

Certain funds might be more appropriate for you than others, depending on your financial objectives and stage of life. And as your financial needs and objectives will unavoidably change as you get older, this could also change.

There are three primary KiwiSaver investment fund types: Growth, Balanced, and Conservative funds, which are designed to accommodate different situations.

What fund should I choose?

When are you planning on buying your first home? Do you want to use your money within the next five years or within the following thirty? To what extent are you willing to take risks?

The responses will assist you in choosing a fund to invest your KiwiSaver money into, such as Growth, Balanced, or Conservative.

How much of my KiwiSaver can I use to buy a house?

If you are elgible for the KiwiSaver First Home Withdrawal, you are able to withdraw your entire balance minus $1000 that must remain in your KiwiSaver account.

Am I eligible for the KiwiSaver First Home Grant

If you’re in KiwiSaver and have been contributing to a scheme for the last three years, you may be eligible for a KiwiSaver First Home Grant. This means that you could get up to $5000 towards an older, existing home, or up to $10,000 towards a newly built home or land to build a new home on.

If you’re borrowing together with someone else, you can combine the grants, which means up to $20,000 if both of you have been contributing for KiwiSaver for five years. (There are other elgibility criteria, as well as regional house price caps)

How much of my KiwiSaver can I use to buy a house?

If you are elgible for the KiwiSaver First Home Withdrawal, you are able to withdraw your entire balance minus $1000 that must remain in your KiwiSaver account.