Claim Your FREE KiwiSaver Report Today!

How much will I have when I need to use it? Try our KiwiSaver calculator

Who Should Care About KiwiSaver?

First Home Buyers

KiwiSaver can help you buy your first home. If you've been in KiwiSaver for at least three years, you may be able to use your savings as a deposit on your first home.

People Who Plan on Living Past 65

You don’t want to be sitting in the corner with a blanket over your legs in retirement. KiwiSaver is one way to make sure you have money set aside to maintain a lifestyle with choices.

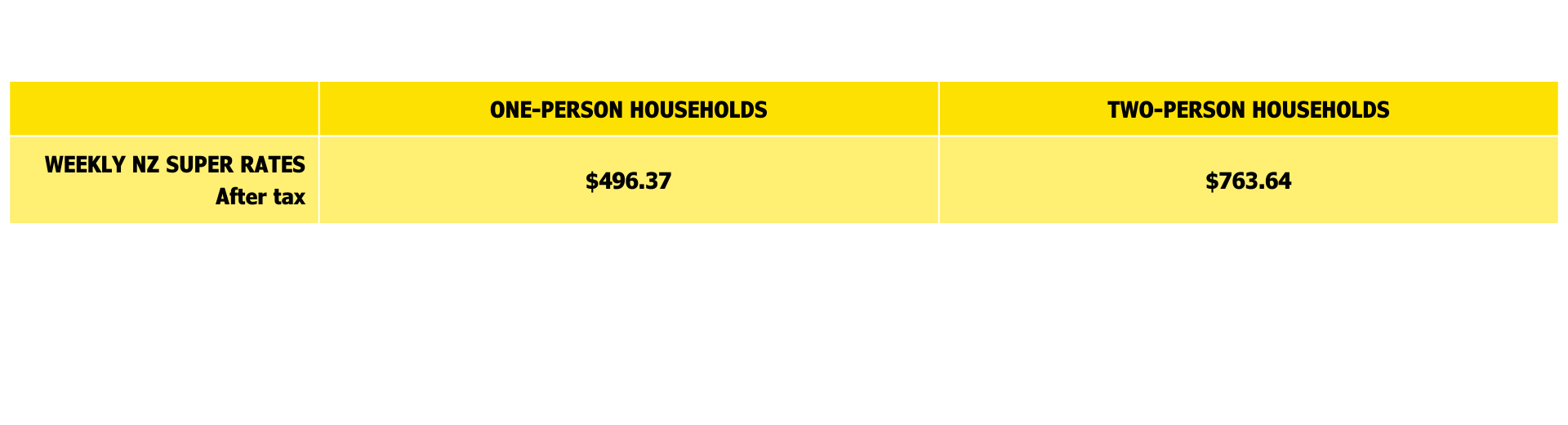

Most New Zealanders aspire to a better standard of living in retirement than can be supported by NZ Superannuation alone.

This study shows the growing difference between how much you might need in retirement depending on your household and location versus what the NZ Super provides you with.

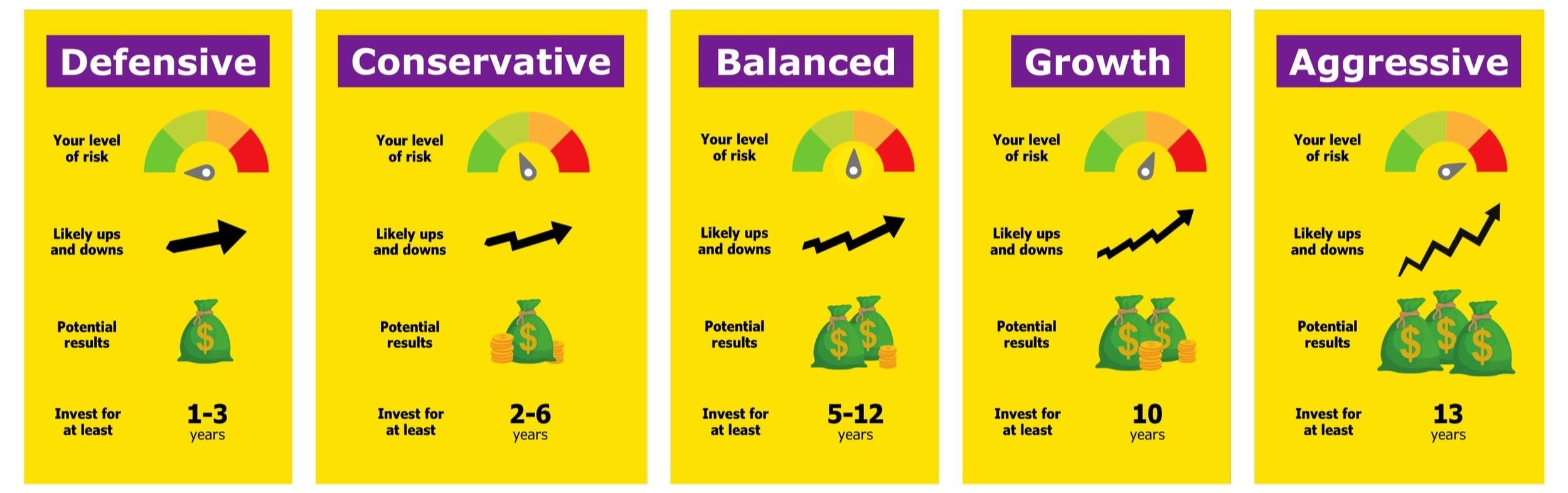

Are you in the correct fund?

We've simplified the many KiwiSaver funds into five categories based on the amount of riskier assets, such as stocks and real estate, that they own.

Depending on how long you are investing for and your attitude towards risk, one type (defensive, conservative, balanced, growth, or aggressive) will probably work best for you.

Frequently Asked Questions

What’s included in the FREE consultation?

Our free consultations act as a discovery meeting. You’ll discuss your goals and future aspirations, analyse your current financial position, formulate an action plan to get you to your goals.

Why are financial plans important?

Many Kiwis are lacking sense of purpose these days. A financial plan can give you clarity of vision and an action plan to get there. You’ll then be able to adjust, and have a measurable plan to keep you achieving.

What other services do you offer?

Our extensive range of services and advice include; Financial Planning, Accounting, Investments, KiwiSaver, Mortgages and Personal Insurances. We deliver tailored financial advice from our team of professional advisers who hold over 250 years of collective experience.

How do I get a plan?

First we start with a discovery meeting to set the appropriate direction and pace. Then your adviser will lead you through a data driven analysis and make some recommendations regarding how you can improve your decision. The last step is implementation.

What is a “Money for Now, Money for Later” Plan?

A "Money for Now, Money for Later" Plan is like having a personal guide on your financial journey, helping you enjoy life today while securing a worry-free tomorrow. It's not about waiting for the stars to align; it's about making your dreams happen, whether it's buying your first home, exploring the world, or ensuring a comfortable retirement.

Just like a competitive athlete has a team to guide them to greatness, this plan involves a friendly financial coach and smart strategies to align your choices with your goals. It's not just about numbers; it's about creating a plan that fits your life.

Think of it as a roadmap that lets you savour the present moments while building a foundation for a secure future. This plan doesn't just remove financial stress; it adds joy to your life by making money a tool for living the way you want—now and later. It's your personal playbook for a fulfilling and financially secure journey.

What happens if I don’t like the advice?

We offer a 100% Satisfaction Guarantee. Our advisers will get to work straight away to start producing your financial plan. After a series of meetings and when we know what you want we will write a plan that shows you how to get there. We’ll present the plan to you and if you’re not happy with the recommendations you can walk out and not pay us a cent.

What is KiwiSaver?

Why should I be in KiwiSaver?

How do contributions work?

Frequently Asked Questions

Why are there different funds?

Certain funds might be more appropriate for you than others, depending on your financial objectives and stage of life. And as your financial needs and objectives will unavoidably change as you get older, this could also change.

There are three primary KiwiSaver investment fund types: Growth, Balanced, and Conservative funds, which are designed to accommodate different situations.

What fund should I choose?

Identifying your savings objectives is a smart place to start. Do you use your fund to save for retirement or your first home? How long do you plan to invest for? Do you want to use your money within the next five years or within the following thirty? To what extent are you willing to take risks?

The responses will assist you in choosing a fund to invest your KiwiSaver money into, such as Growth, Balanced, or Conservative.

How much of my KiwiSaver can I use to buy a house?

If you are elgible for the KiwiSaver First Home Withdrawal, you are able to withdraw your entire balance minus $1000 that must remain in your KiwiSaver account.

When can I access my KiwiSaver nest egg?

You might wish to use your KiwiSaver funds for a major life event now that you have some money saved.

You have the option to put down a portion of your funds for your first house.

Or when you reach the age of 65, you can utilise your funds to sustain yourself while you finally take that well-deserved vacation.

And occasionally you get curveballs in life. You might discover that you're dealing with a major disease or severe financial difficulties.

You can seek to access your KiwiSaver savings in the event that any of those things occur to help you get through these difficult times.

Am I eligible for the KiwiSaver First Home Grant

If you’re in KiwiSaver and have been contributing to a scheme for the last three years, you may be eligible for a KiwiSaver First Home Grant. This means that you could get up to $5000 towards an older, existing home, or up to $10,000 towards a newly built home or land to build a new home on.

If you’re borrowing together with someone else, you can combine the grants, which means up to $20,000 if both of you have been contributing for KiwiSaver for five years. (There are other elgibility criteria, as well as regional house price caps)

Socially Responsible Investing

Align your values with your investment by avoiding harmful industries

Not a fan of animal testing, fossil fuels, or some of the other controversial industries? Consider a fund that restricts investments in them.