Don’t just have a plan, have a FoxPlan

Effortlessly manage your money for peace of mind

Secure your retirement while living life to the fullest

Attain financial security and protect those who matter most

Financial Planning for Kiwis.

It’s as easy as 1,2,3.

Many prospective clients we meet live week to week. They spend first and save second, leaving financial stresses on themselves and their families. Here at FoxPlan, we offer a safe place to talk about money with trusted Advisers that sit on the same side of the table as you.

We help people understand their current financial situation, assist them with knowledge and skills, as well as offer guidance and advice to achieve their short, medium and long-term goals. A total Financial Plan consists of three key areas; control of money, confidence in your investments and certainty of plan B.

Retire with Choices by Bridging the Income Gap

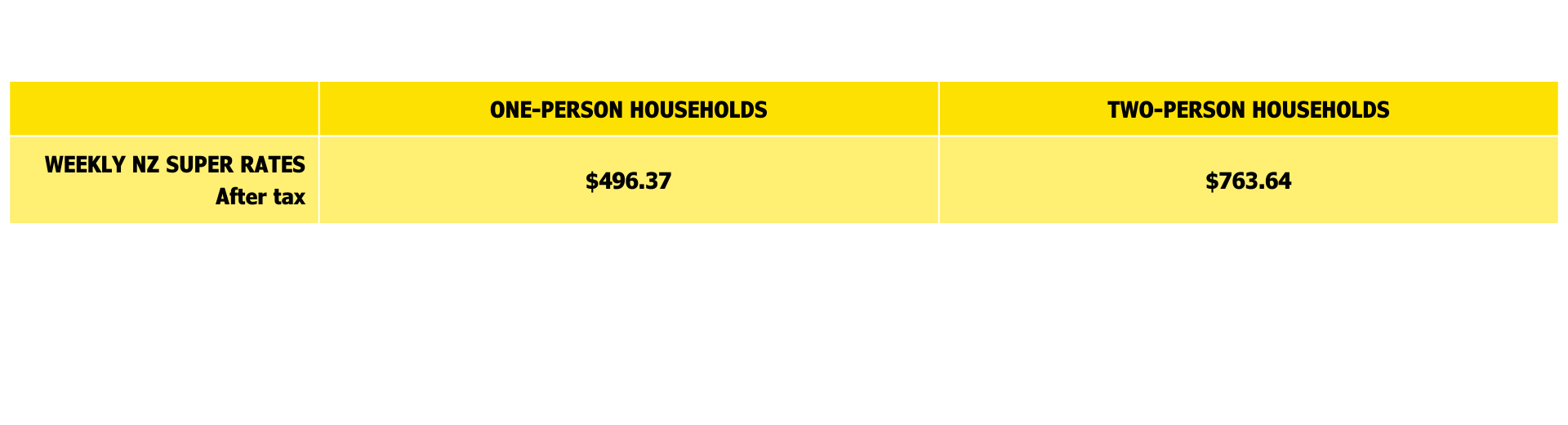

Most New Zealanders aspire to a better standard of living in retirement than can be supported by NZ Superannuation alone.

Will 50% of your income get you 100% of your lifestyle and keep you going for 30 years?

This study shows the growing difference between how much you might need in retirement depending on your household and location versus what the NZ Super provides you with.

How does a Financial Plan actually work?

Draw a line in the sand and understand your current situation.

Set the foundation. If weight loss is a goal you need to measure how much you weigh. This is similar to starting a Financial Plan, you need to know what money is coming in and what is going out. For most people, this has not previously been a priority.

1. Start with the end in mind. Where do you want to be?

The most important thing about planning is having a strong vision. Without this vision you won’t change your habits or make the daily decisions necessary to achieve your goals. We challenge you to think outside of the goal, ie. Saving money – why, how much and what do you want to save for? The more specific you are, the stronger the vision will be. We recommend you research SMART goals.

2. Accept advice and formalise your plan to succeed.

The plan is based on the quantitative (numbers) and qualitative (the why). Some goals may take priority over others due to specific timeframes. Once your plan is written you should not deviate. The only reason to modify your plan would be goals changing.

3. Get out of debt faster with the correct structure.

Part of financial planning is about reducing debt. Debt is not necessarily a bad thing, for example having a mortgage. We will advise you on how to reduce your debt – so you don’t pay as much interest, and with minimal impact on lifestyle or your plan.

4. Know your inputs and outputs, and maximise your investments.

This is about record keeping or tracking your goals. The more you keep track, the more you will appreciate the plan. As you see the incremental growth you may find yourself committing more to achieving your goal faster. Maximising is about making sure you use your resources to the maximum potential. Some rebalancing may be required or redistribution of the surplus to the goals.

5. Offset risks via insurance and legal agreements to protect yourself and your family.

Let’s look at a common example; people start saving, they have some success, then a bill comes out of nowhere - destroying the hard work they have done. In an ideal world, things would happen exactly how we want, but we can’t predict the future. This is why it is vital to have a contingency plan, in case such things happen. There is more than just money to protect; consider wills, estate planning, and the appropriate insurance solutions.

6. Be proactive and implement strategies.

Once the strategies are agreed and the time frames set, the plan will begin. You may struggle at the beginning as it requires you to change habits. But that is a good thing! It can often take up to 66 days to form a new habit. Once the strategies are in place, consistency is key.

7. Meet with Financial Professional to review progress.

Accomplishing a goal may take a long time, which is why it is important to review on a regular basis. What is important is that you are able to compare where you started and where you are now. A 3-6 month meeting with your coach will ensure you are following and achieving your goals.

100% Satisfaction Guaranteed

If you don't like the plan - walk away and don't pay us a cent!

We will take payment only when the plan is delivered and agreed upon, meaning that if you don't like the plan you can throw it in the bin and we won't charge you a cent - we'll carry all the risk!

What Our Clients Say About Us

“Highly recommend going to speak to Melanie!

She is wonderfully empathetic and insightful.

It’s obvious she cares highly about her clients future with the wonderful advice she provides to help build my financial future!”

“I have worked with many ‘financial planners’ and Warwick and FoxPlan are top shelf. Warwick is knowledgeable and easy to deal with - for all levels of financial planning I throroughly recommend FoxPlan.”

“Brodie is really smart and cares about his clients goals. He’s helped me with a few minor things that will now play a big part in my financial future. I’d highly recommend calling Brodie to see what value he could bring to your life.”

Frequently Asked Questions

What’s included in the FREE consultation?

Our free consultations act as a discovery meeting. You’ll discuss your goals and future aspirations, analyse your current financial position, formulate an action plan to get you to your goals.

Why are financial plans important?

Many Kiwis are lacking sense of purpose these days. A financial plan can give you clarity of vision and an action plan to get there. You’ll then be able to adjust, and have a measurable plan to keep you achieving.

What happens if I don’t like the advice?

We offer a 100% Satisfaction Guarantee. Our advisers will get to work straight away to start producing your financial plan. After a series of meetings and when we know what you want we will write a plan that shows you how to get there. We’ll present the plan to you and if you’re not happy with the recommendations you can walk out and not pay us a cent.

Will I/We have enough money to retire when we want to?

Will I/ We run out of money during retirement?

Can retirement planning really help us?

How do I get a financial plan?

First we start with a discovery meeting to set the appropriate direction and pace. Then your adviser will lead you through a data driven analysis and make some recommendations regarding how you can improve your decision. The last step is implementation.

Who can I contact if I want to discuss these tips further?

Our expert Financial Advisers are more than willing to help guide you through these tips and apply them to your individual situation.

What other services do you offer?

Our extensive range of services and advice include; Financial Planning, Accounting, Investments, KiwiSaver, Mortgages and Personal Insurances. We deliver tailored financial advice from our team of professional advisers who hold over 250 years of collective experience.