Invest, Nest, Rest: KiwiSaver’s Role in Your First Home and a Secure Retirement

What is KiwiSaver?

Why should I be in KiwiSaver?

How do contributions work?

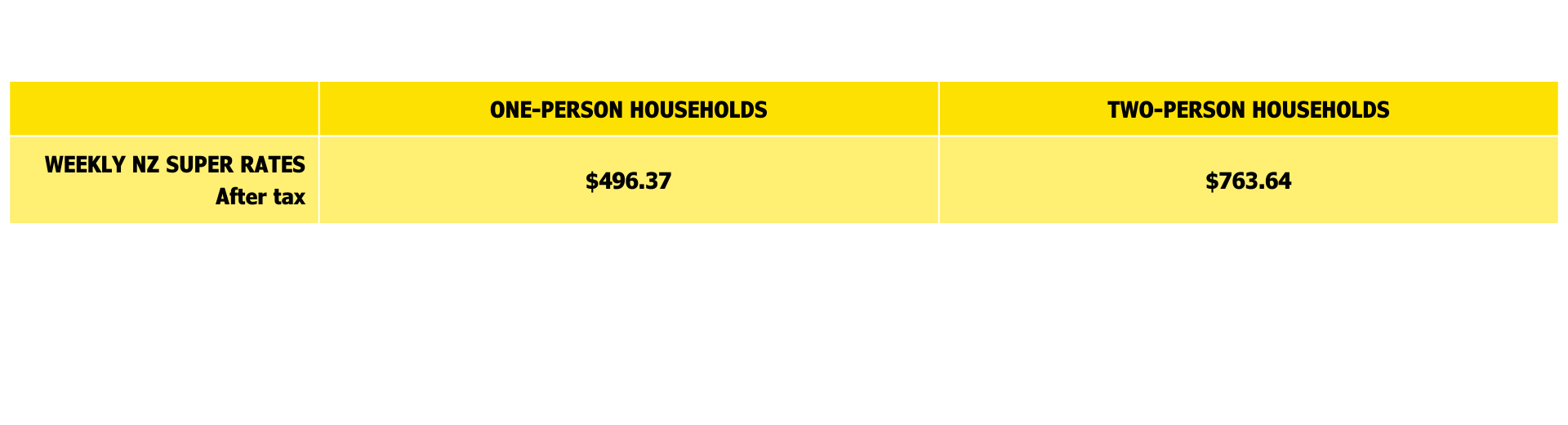

Most New Zealanders aspire to a better standard of living in retirement than can be supported by NZ Superannuation alone.

This study shows the growing difference between how much you might need in retirement depending on your household and location versus what the NZ Super provides you with.

Who Should Care About KiwiSaver?

First Home Buyers

KiwiSaver can help you buy your first home. If you've been in KiwiSaver for at least three years, you may be able to use your savings as a deposit on your first home.

People Who Plan on Living Past 65

You don’t want to be sitting in the corner with a blanket over your legs in retirement. KiwiSaver is one way to make sure you have money set aside to maintain a lifestyle with choices.

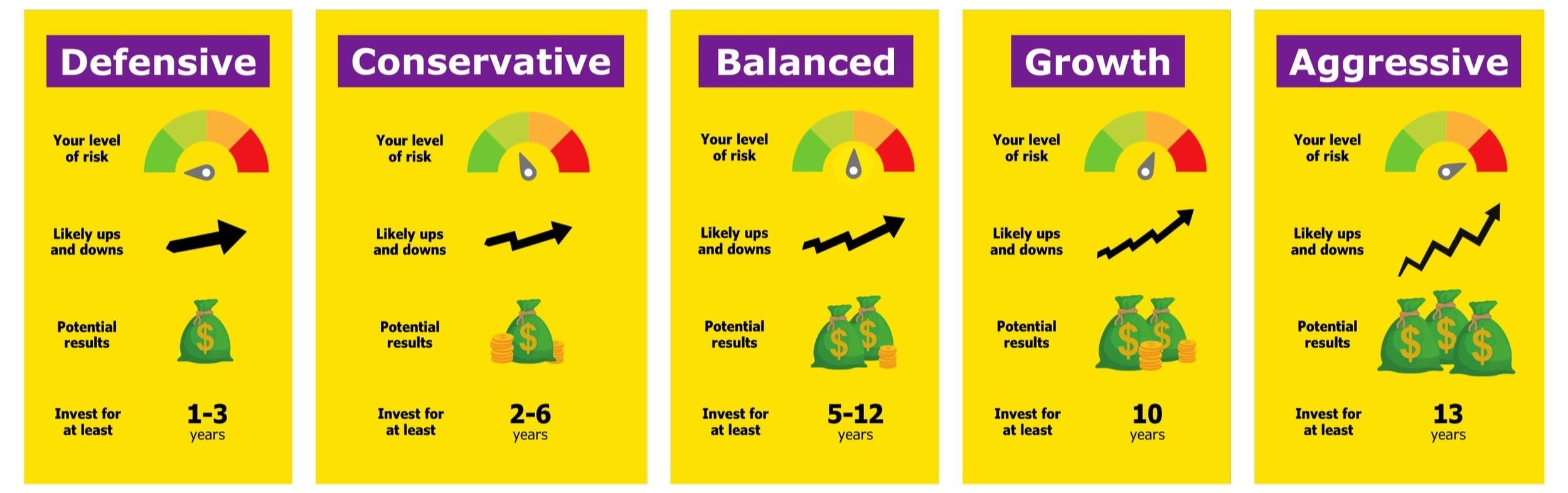

Are you in the correct fund?

We've simplified the many KiwiSaver funds into five categories based on the amount of riskier assets, such as stocks and real estate, that they own.

Depending on how long you are investing for and your attitude towards risk, one type (defensive, conservative, balanced, growth, or aggressive) will probably work best for you.

Frequently Asked Questions

What is KiwiSaver?

To explain KiwiSaver simply, you contribute from your pay each week and in addition, your employer and government contribute on your behalf. The amount and frequency depend on your employment. Your contributions then get invested on your behalf by a KiwiSaver provider.

Why are there different funds?

Certain funds might be more appropriate for you than others, depending on your financial objectives and stage of life. And as your financial needs and objectives will unavoidably change as you get older, this could also change.

There are three primary KiwiSaver investment fund types: Growth, Balanced, and Conservative funds, which are designed to accommodate different situations.

What fund should I choose?

Identifying your savings objectives is a smart place to start. Do you use your fund to save for retirement or your first home? How long do you plan to invest for? Do you want to use your money within the next five years or within the following thirty? To what extent are you willing to take risks?

The responses will assist you in choosing a fund to invest your KiwiSaver money into, such as Growth, Balanced, or Conservative.

When can I access my KiwiSaver nest egg?

You might wish to use your KiwiSaver funds for a major life event now that you have some money saved.

You have the option to put down a portion of your funds for your first house.

Or when you reach the age of 65, you can utilise your funds to sustain yourself while you finally take that well-deserved vacation.

And occasionally you get curveballs in life. You might discover that you're dealing with a major disease or severe financial difficulties.

You can seek to access your KiwiSaver savings in the event that any of those things occur to help you get through these difficult times.

How do contributions work?

If you’re employed by a company and you elect to join, you will contribute either 3%, 4% or 8% of your salary before tax, to your KiwiSaver account. If you are self-employed, you will contribute as an employer an amount that is appropriate for you. In both circumstances the government will match 50c for every dollar that you contribute up to a maximum of $521 per year, this is called a member tax credit. In addition to your contributions, the investment will also make returns (growth) which will add up to be a large part of your fund in the long run

Socially Responsible Investing

Align your values with your investment by avoiding harmful industries

Not a fan of animal testing, fossil fuels, or some of the other controversial industries? Consider a fund that restricts investments in them.